Our industry

Economic value of the cosmetics

and personal care industry

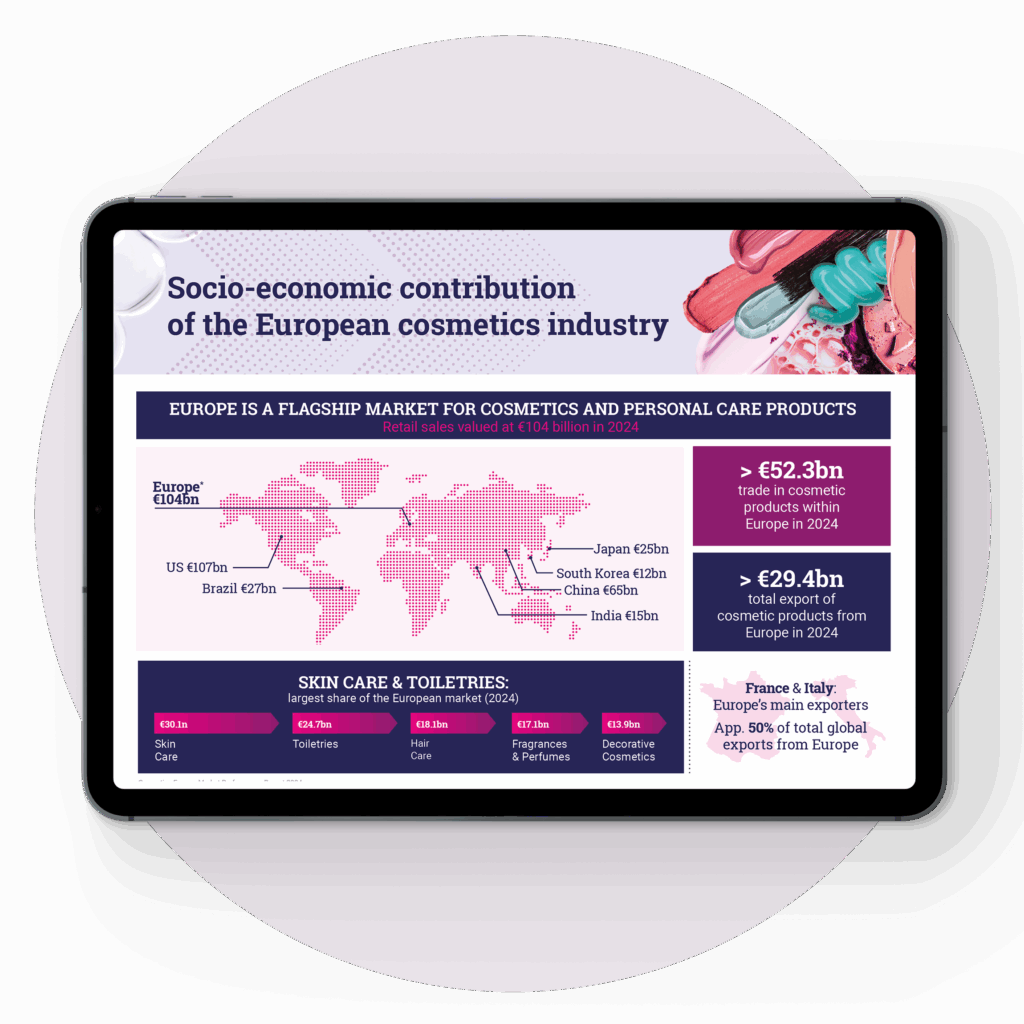

Europe is a flagship market for cosmetics and personal care products, with retail sales valued at €104 billion in 2024.

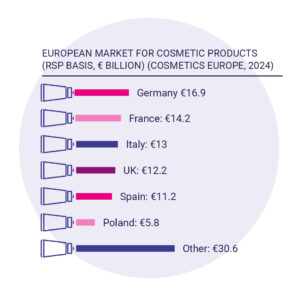

The biggest European markets for cosmetics and personal care products are Germany (€16.9 billion) and France (€14.2 billion). These are followed by Italy (€13 billion), the UK (€12.2 billion), Spain (€11.2 billion) and Poland (€5.8 billion).*

Skin care is the biggest product category, valued at €30.1 billion, followed by toiletries (€24.7 billion), hair-care products (€18.1 billion), fragrances and perfumes (€17.1 billion) and decorative cosmetics (€13.9 billion).*

Cosmetic products are an extremely valuable European export, with an export value of €29.4 billion in 2024. France and Italy were the leading exporters, accounting for over 50% of total global exports from Europe at over €14.9 billion.

*Based on Market Performance 2024, European Cosmetic, Toiletry & Perfumery Data.

Supporting Europe’s wider economy

The European economy benefits from €29 billion of added value annually from the cosmetics and personal care industry. €11 billion is generated directly from the manufacture of cosmetic products, with a further €18 billion contributed indirectly by the supply chain (Eurostat 2015).

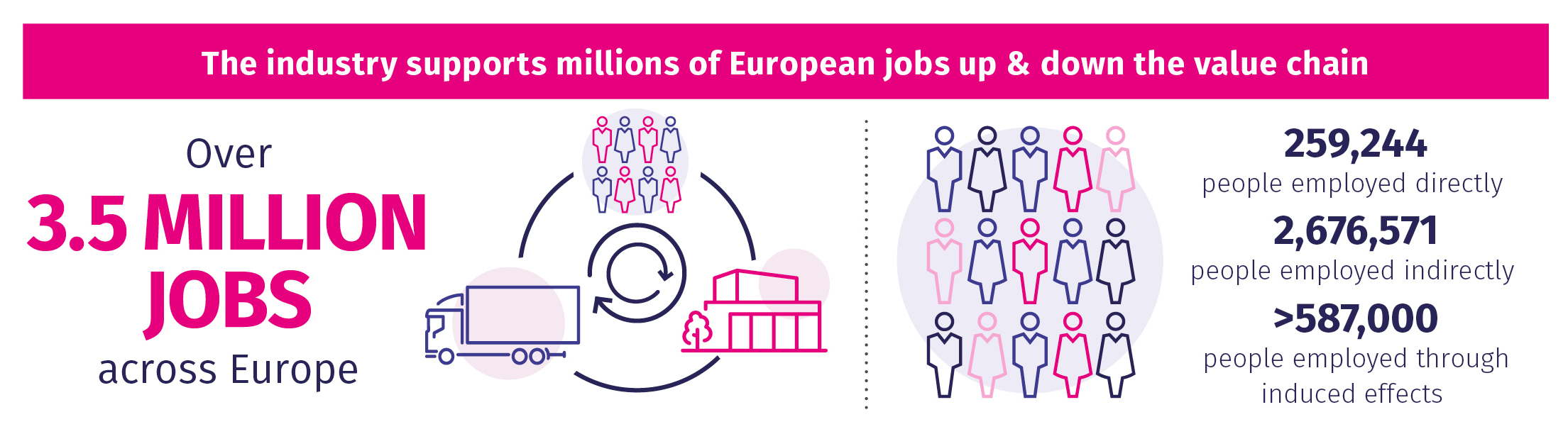

The industry supports over 3.5 million jobs through a mixture of direct, indirect and induced economic activity. In 2023, nearly 260,000 people were directly employed in the sector, with a further close to 2.7 million working in the cosmetics value chain.

On top of this, for every 10 workers employed in Europe’s cosmetics and personal care industry, at least two further jobs are generated in the wider economy. This is due to the impact of employees spending their wages on goods and services.

As well as supporting millions of jobs, the cosmetics and personal care industry contributes to Europe’s economy in many other ways. These include attracting investment from outside the EU; developing assets like brands; and expenditure on R&D. This helps to enhance the competitiveness of the European economy and contributes to future prosperity.

Europe’s 500 million consumers use cosmetic and personal care products every day to protect their health, enhance their well-being and boost their self-esteem. Some of the most widely used products include antiperspirants, fragrances, make-up and shampoos, along with soaps, sunscreens and toothpastes. Cosmetics play an essential role in all stages of our life and have important practical and emotional benefits.