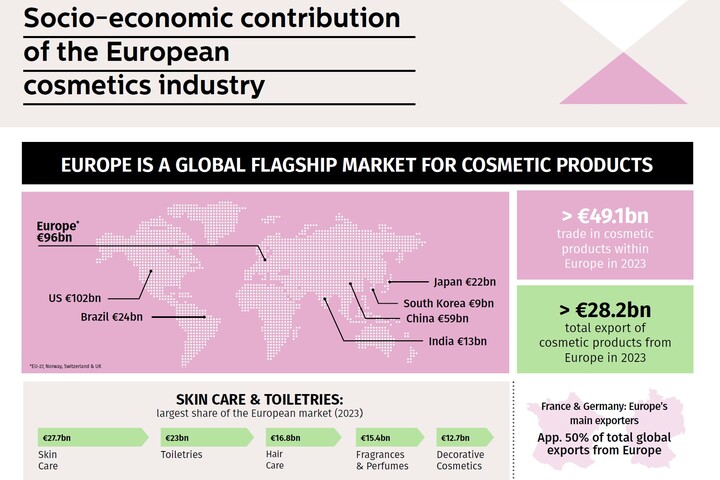

The following product categories hold the largest share of the European market: skin care (€27.7 billion) and toiletries (€23.0 billion), followed by hair-care products (€16.8 billion), fragrances/perfumes (€15.4 billion), and decorative cosmetics (€12.7 billion) *.

Exports of cosmetic products from Europe totalled €28.2 billion (trade value) in 2023. France and Germany were Europe’s main exporters, exporting over €14.0 billion between them and accounting for nearly 50% of total global exports from Europe.

*Based on Market Performance 2023, European Cosmetic, Toiletry & Perfumery Data.

It is estimated that the cosmetics and personal care industry brings at least €29 billion in added value to the European economy annually. €11 billion is contributed directly by the manufacture of cosmetic products and €18 billion indirectly through the supply chain (Eurostat 2015).

Including direct, indirect and induced economic activity, the industry supports over 3.5 million jobs. In 2023, over 259,244 people were employed directly, and a further 2.68 million indirectly in the cosmetics value chain.

For every 10 workers employed in the European cosmetics and personal care industry, at least two further jobs are generated in the wider economy as a result of employees spending their wages on goods and services.

Moreover, by attracting investment from outside of the EU, developing intangible assets like brands, and investing in R&D, the cosmetics and personal care industry is helping to enhance the competitiveness of the European economy and contributing to future prosperity.

The vast majority of Europe’s 500 million consumers use cosmetic and personal care products every day to protect their health, enhance their well-being and boost their self-esteem. Ranging from antiperspirants, fragrances, make-up and shampoos, to soaps, sunscreens and toothpastes, cosmetics play an essential role in all stages of our life and have important functional and emotional benefits.

Industry value-chain

The cosmetics and personal care industry value chain comprises five levels:

- Inputs to production. Companies that provide the raw materials required to manufacture cosmetic and personal care products. In 2024, there were over 140 companies manufacturing cosmetic ingredients in Europe.

- Manufacturing. Product manufacturers and suppliers of supporting activities e.g. marketing and IT. In 2023, nearly 9000 SMEs were involved in the manufacturing of cosmetics in Europe.

- Distribution and wholesale. In 2020, there were approximately 23,600 enterprises involved in the wholesale of cosmetics in Europe, the majority of which were located in Italy (19%), Spain (18%), and France (10%) (Eurostat, 2020).

- Retail and beauty services. These include product vendors like salons, department stores, online stores and pharmacies. In 2020, there were approximately 42,400 specialised stores in the EU (Eurostat 2020).

- Consumers. Individuals who purchase cosmetics and personal care products represent the final link in the value chain.

Over 27,500 scientists are employed in the cosmetics sector in Europe, from a diverse range of disciplines including physics, microbiology, biology, toxicology, physiology, rheology, nanoscience, analytical chemistry and genetics to name a few.

By attracting and training workers with specialist skills, the cosmetics industry increases the pool of talent and skilled labour for other science-led industries - such as pharmaceuticals.